Frequently Asked Questions

What is an LEI code?

LEI is an abbreviation of the Legal Entity Identifier.

An LEI code makes it possible to uniquely identify companies and other legal entities (associations, foundations, legends, etc.) to ensure transparency and stability in the global financial markets.

An LEI code or LEI number can be compared to a global business registry number

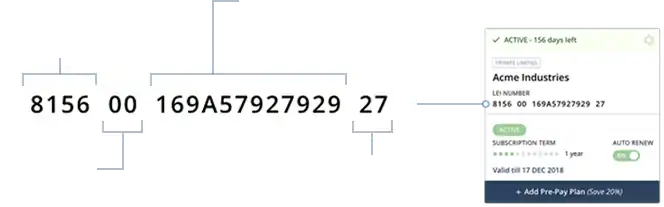

The LEI code or LEI number consists of 20 characters and is an alphanumeric code based on the global ISO 17442:2012 standard

The LEI code or LEI number is composed of four elements:

Characters 1-4:

Identifies which LOU has issued the code.

Characters 5-6:

Reserved for future functionality

Characters 7-18:

Identifies the individual legal entity

Characters 19-20:

Two control digits

General Questions

An LEI code, or an LEI number , is an abbreviation for the English term, Legal Entity Identifier. It is a standardized code of 20 characters consisting of both digits and letters. The LEI code makes it possible to uniquely identify a company or other legal entity that deals in securities and carries out financial transactions.

on the page:

- Apply for a new LEI code by clicking on “Create new LEI code”

- Log in or create a new profile and enter your business number

- Submit your application and get your LEI code within 0-2 business days

If you need an LEI code on the same day, e.g., before the stock exchange closes, you can use our 'Express LEI Service'

It is mandatory for all companies and legal entities that buy or sell securities to have an LEI code. The term 'legal entity' includes all types of companies, associations, foundations and endowments, etc. This legislation was effective as of January 3, 2018.

If you are investing as a private individual, you do not need to have an LEI code or LEI number.

The global LEI system came about in the wake of the financial crisis in 2008. The G20 countries requested a system that would strengthen the supervision of the markets and make it possible to identify which companies, foundations, companies or similar stands behind a trade in the financial markets. The legislation, which makes it mandatory to have an LEI code, entered into force on 3 January 2018.

You can see prices for creating and renewing an LEI code with us below. If you already have an LEI code and would like to move it to our platform , it is easy and free to do, and we can help you here .

Create a new LEI code:

- 1 year EUR 77

- 3 year EUR 65.50 Cost / Year - (196.5 Total Price)

- 5 year EUR 61.70 Cost / Year - (308.5 Total Price)

Renewal of existing LEI code:

- 1 year EUR 77

- 3 year EUR 65.50 Cost / Year - (196.5 Total Price)

- 5 year EUR 61.70 Cost / Year - (308.5 Total Price)

All prices are excl. VAT, but include the GLEIF fees and unlimited data maintenance throughout the period

Global FinReg is a leading LEI registration agent, and we offer the best platform for handling LEI codes. As the only ones in the market, we offer automatic updating of your company data through the Danish Business Authority, so you don't have to do anything.

Our company has existed since 2017, and we are recommended by all the largest banks and investment firms in Denmark. They know that data security is our number one priority, and that we would never compromise customer data. Our objective is simple: we want to be the best LEI provider in the world.

The founder and owner of Global FinReg is David Silverman. David lives in Copenhagen with his Danish wife and their two children. David has had a long career in the financial sector on the buy side and as an IT analyst. He worked in New York during the financial crisis in 2008, and it was then he first thought of having a company to help remedy the lack of transparency in the ownership structure of companies.

It is not a good idea to buy your LEI code from the cheapest provider . Some providers offer a cheap LEI code to attract new customers, and then suddenly increase the price dramatically. They may even wind up selling your LEI code to other LEI providers.

You have to make sure that you do not pay for a long validity period with a LEI provider that goes bankrupt, and that your LEI provider does not sell your information to a third party. You can do so by choosing a provider with a proven track record and recommendations from banks and investment firms.

You should also make sure that you are purchasing your LEI code from a provider accredited by GLEIF and that the price includes all fees and charges.

The answer is YES. When you buy an LEI code from us, you can safely trust that we will never compromise or resell your personal information. Your email address, name and telephone number are used exclusively as a means of communication between you and us, so that you may experience the best possible service.

We are recommended by all the largest banks and asset managers in Denmark, because they know us and know that security is our first priority.

Here you can read about how your information is processed .

No, unfortunately, if you have several companies, you must have an LEI code for each company. An LEI code is a unique identification code that is associated with a company's registration number. It cannot be moved from one company to another.

It is called both LEI code and LEI number. The two terms, LEI code and LEI number, are used interchangeably and refer to the same thing. At Global FinReg, we also use both terms, LEI code and LEI number.

Banks and asset managers are often asked for their customers' LEI code. If you do not have an LEI code, or your LEI code is not valid because it has expired , then your bank or asset manager will not let you trade in securities.

It usually takes between 0-2 business days to get an LEI code. If you need to get your LEI code faster, you can choose our 'Express LEI Service' and have an LEI code issued already today.

With our 'Express LEI Service' you save time and hassle, because we handle your LEI code registration for you and help gather the documents from the corporate registries. You can order Fully Assisted LEI Service here here .

GLEIF, the Global Legal Entity Identifier Foundation, is behind the LEI system . GLEIF is an international, not-for-profit organization headquartered in Basel, Switzerland. GLEIF's mission is to support the implementation and use of LEI codes to promote transparency in global financial markets. It is also GLEIF that monitors the LEI service providers.

You can read more about GLEIF on their website www.gleif.org

An LEI code is issued by accredited Local Operating Units (LOU), which are GLEIF approved organisations. LOUs are mandated to create , change and renew LEI codes. All issued LEI codes are collected in an open database at www.gleif.org

Still have questions

Write To Us